You've got INVESTING goals. We've got investing solutions.

Invest in real estate

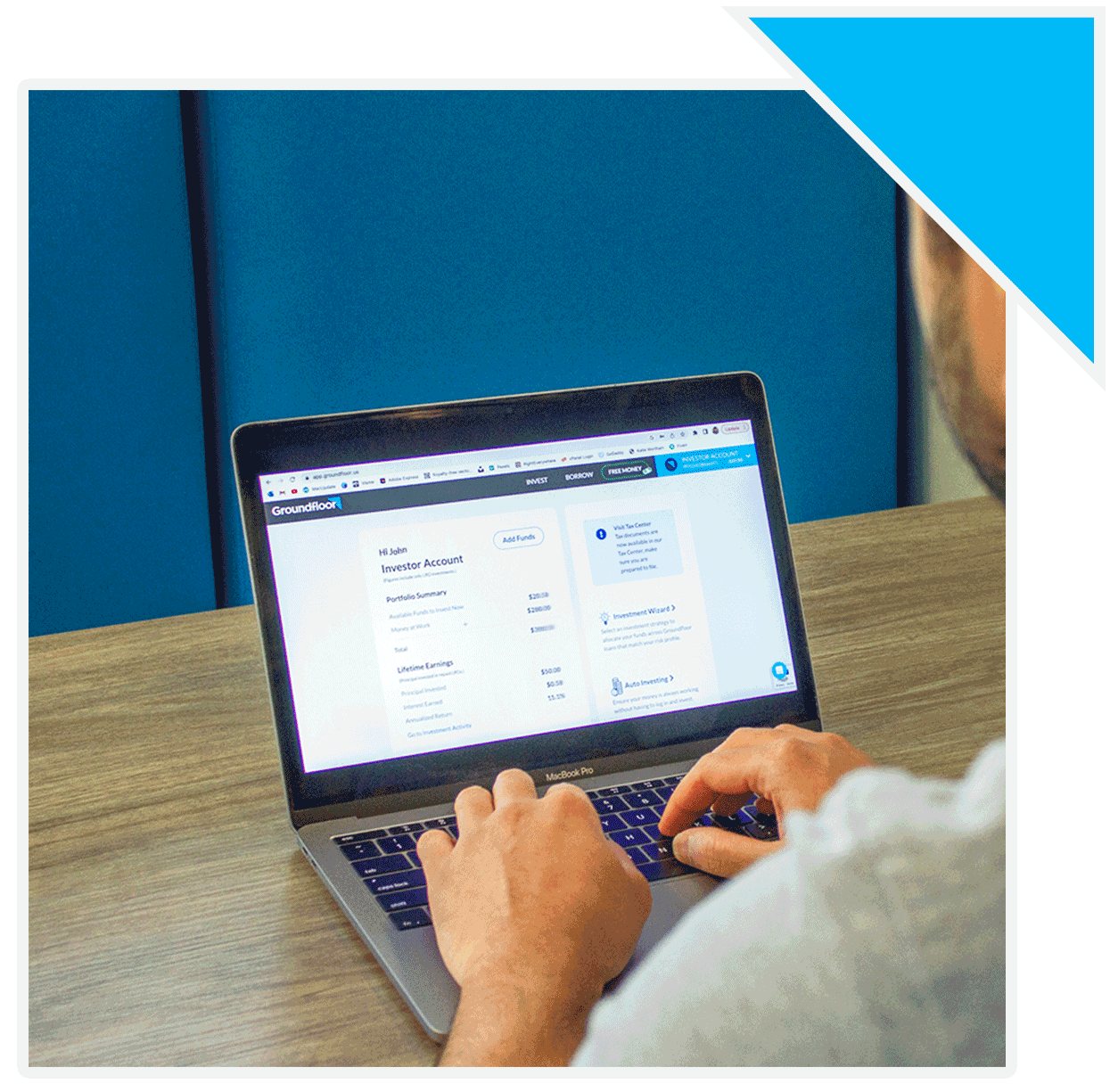

It's never been easier to start investing in your future! Start earning 10% or more with just a few clicks.

Real Estate Investing - Now for Everyone

Groundfloor offers the best of all worlds: short-term real estate investments with high-yield returns, and it takes only $10 to get started.

Why Become a with Real Estate Investor with Groundfloor?

Looking to break into real estate investing?

Investing in real estate is made simple at Groundfloor – we offer debt investments to accredited, non-accredited and even international investors. With a low minimum of just $10 needed for entry – there’s no reason you can’t start making high returns on private real estate right away! Perfect for passive investors looking to generate short term gains without paying any fees.

Take charge of your investments, and expand beyond the traditional stock market with Groundfloor. With a low minimum account balance requirement, you can start investing in private real estate for returns as high as 10%. Every loan is backed by an underlying project or projects to mitigate risk. Our grading system which ranges from A-G – Grade A loans have potentially lower expected risks while still providing attractive yields designed to help you build wealth over time.

Our company offers fractional real estate investments qualified for public sale – making it easy for any real estate investor! With recurring real estate investments and short-term loans investments, your real estate portfolio can generate cash flow in as little as nine months. A well-diversified real estate investment portfolio can provide a steady income stream through your Groundfloor real estate investments.

Your real estate investment portfolio can be made up of different types of properties, in other locations, and with varying levels of risk and return potential. Over 2,000,000 individual real estate investments have been made to date. Join today and start investing in residential real estate

Why Invest With Groundfloor

Steady Cash Flow

Looking to increase your monthly passive income? Groundfloor offers an innovative way for anyone, regardless of their financial background, to start investing in real estate. With fractional investments and quick returns on residential property flips - it's easy! Investing with Groundfloor helps finance home flippers while creating a profitable portfolio that pays out within months.

10% Annual Returns

Over the last 10 years, we've consistently averaged 10% annual returns for investors. With Groundfloor, you can generate high-yield returns with minimal start-up costs. With just a few clicks you'll have the chance to build a thriving portfolio of short-term loans and real estate investments. Enjoy cash flow in just a few months - it's hassle free investing at its best!

Long-Term Security

Groundfloor offers exceptional returns for real estate investors looking to capitalize on long-term investments. The platform adds a unique twist, with the potential for up to 10% in consistent annual yields - allowing users to build wealth and make informed decisions about their finances over time.

Designed for Everyone

Real estate investing is a great way to build wealth and achieve financial freedom. Whether you're a seasoned investor or just starting out, there are many ways to invest in real estate that can help you achieve your goals. Within minutes you can be a real estate investor and join the ranks of other investors.

Real Estate Debt Investments, qualified for public sale, offering high-yield and short-term investment opportunities for everyone. Perfect for passive investors looking to generate short term gains without paying any fees. Take charge of your investments, and expand beyond the traditional stock market with Groundfloor.

Looking to add some variety to your investment portfolio? Groundfloor Notes might just be the perfect solution! Boasting yields that easily surpass the rates of Treasury Bills, this investment opportunity provides a smart way to diversify your assets while enjoying short-term stability.

Qualified for public sale real estate debt Investments offering high-yield and short-term investment opportunities for everyone. Perfect for passive investors looking to generate short term gains without paying any fees. Take charge of your investments, and expand beyond the traditional stock market with Groundfloor