Spread the Word: Earn $50 for Every Referral When They Invest $100.

High-Yield, No-Fee Investing

Build Your

With Groundfloor

Enjoy the benefits of fractional real estate investing with just $10. Our automatic investing platform makes it easier than ever to diversify your portfolio and elevate your earning potential.

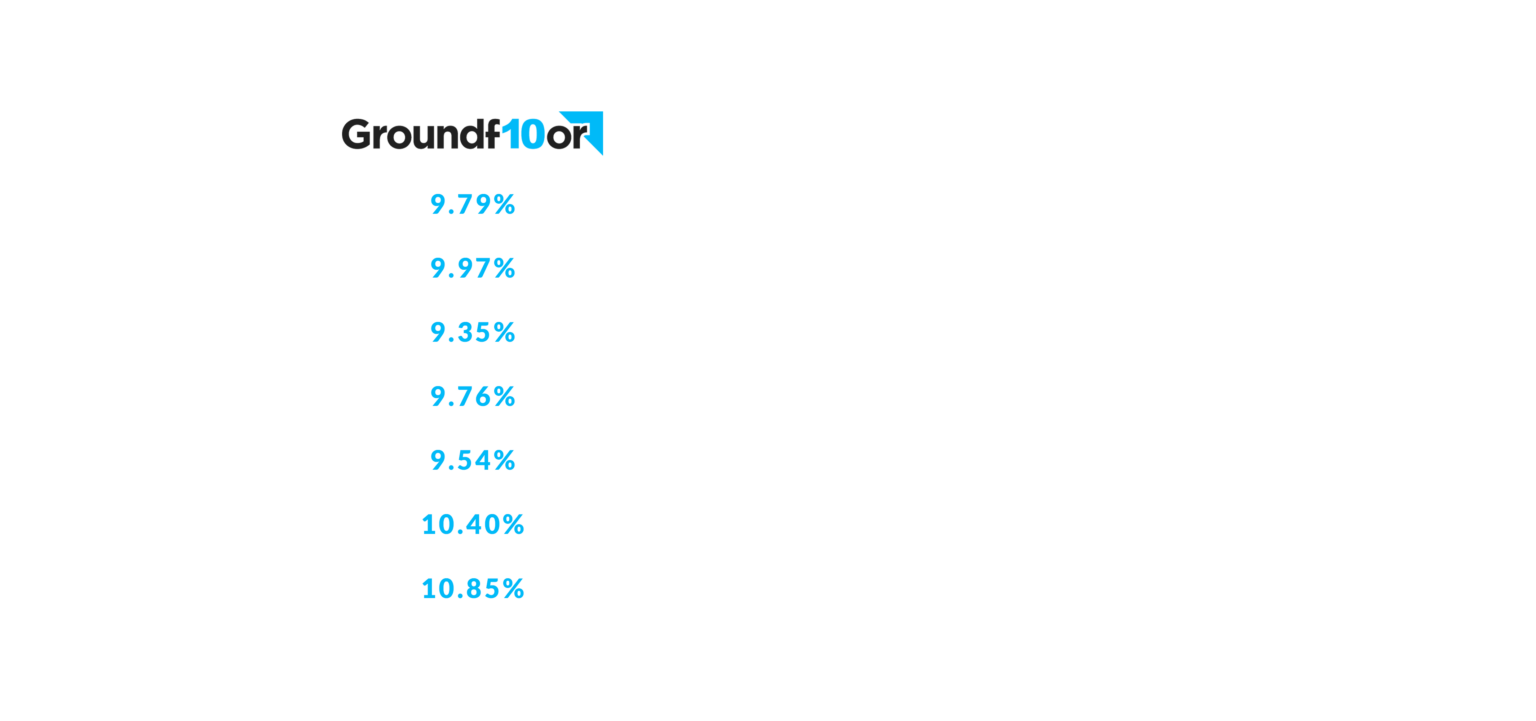

No heavy lifting. No fees. Just historic 10% returns.

No heavy lifting. No fees. Just historic 10% returns.

Get Started

Grow Your Wealth With

Automatic Investing

- $10 minimum to start

- Backed by real estate

- Simple and easy to use

- 10x higher yields than REITs

Enjoy true set-it-and-forget-it investing with the Auto Investor Account. As soon as funds hit your account, they’ll be automatically invested across all available loans on our platform. Your funds are then reinvested upon repayment, so you can sit back and watch the yields come in.

Registered Investors

0

K+

Years in Business

0

Historic Returns

0

%

Investment Volume

$

0

B+

Fractional real estate debt, qualified for public sale, offering high yields with short terms

Publicly issued, non-traded, shorter-term debt collateralized and secured by real estate assets

Getting Started Is Easy

How It Works..

Investing With Groundfloor

- 1) Create An Account

- 2) Link Bank

- 3) Start Investing

Getting Started With Groundfloor

Creating an account to invest on Groundfloor is simple. Click on the “Get Started” button above and follow the user-friendly registration steps. You’ll provide essential information, like your email address, password, and personal details.

Once your account is set up, you’ll have access to a platform that empowers you to explore and invest in fractional real estate investments to help you grow your wealth. Take the first step toward financial freedom by creating your Groundfloor account today.

Creating an account to invest on Groundfloor is simple. Click on the “Get Started” button above and follow the user-friendly registration steps. You’ll provide essential information, like your email address, password, and personal details.

Once your account is set up, you’ll have access to a platform that empowers you to explore and invest in fractional real estate investments to help you grow your wealth. Take the first step toward financial freedom by creating your Groundfloor account today.

Link Your Bank To Get Started

Once your bank’s linked, you’re all set to dive into the investing action on our platform! With your account synced up, you can easily jump into exploring the array of exciting real estate opportunities we have waiting for you.

Whether you’re a seasoned investor or just starting out, our platform provides the tools and support you need to make informed decisions and maximize your returns.

Once your bank’s linked, you’re all set to dive into the investing action on our platform! With your account synced up, you can easily jump into exploring the array of exciting real estate opportunities we have waiting for you.

Whether you’re a seasoned investor or just starting out, our platform provides the tools and support you need to make informed decisions and maximize your returns.

Start Earning Passive Income

Easily earn a consistent stream of passive income with Groundfloor. It’s never been easier getting started investing as little as $10 on the platform.

With Groundfloor’s automatic investing, your investments are automatically invested and reinvested across a wide array of available loans. So sit back and relax with this true set-it-and-forget-it model.

Easily earn a consistent stream of passive income with Groundfloor. It’s never been easier getting started investing as little as $10 on the platform.

With Groundfloor’s automatic investing, your investments are automatically invested and reinvested across a wide array of available loans. So sit back and relax with this true set-it-and-forget-it model.

Start Investing Today

Resolve to earn real

Passive Income

- Get started with just $100

- Invest in Real Properties

- Qualified for Public Sale

- Repayments by Month 1

- Cash Flow by Month 3

- Passive Income by Month 12

With historical return rates at 10%, Groundfloor provides you a low barrier to entry, easy path to diversification and puts you in a first lien position.

Don’t let stock market volatility hold you back from investing. Real estate investing is a historically stable asset class and not impacted by geopolitical views and corporate earnings reports.

Accredited and non-accredited investors can join Groundfloor. With lower minimums, shorter terms, and no fund lock-ups or manager-controlled payouts, Groundfloor optimizes your alternative investments.

Data as of July 2023. Sources: Investopedia; Macrotrends; Bankrate.

- List Item #1

- List Item #1

- List Item #1

- List Item #1

- List Item #1

Testimonials

See What Our Investors Have To Say

Groundfloor provides an easy way to set up a diversified investment into various real estate properties. You can choose your level of risk from lower yielding A-rated projects and higher yields.

Groundfloor answers the common investor delima. How to invest in Real Estate and get the banks out of our profits. Example: I invested $1,500 on 7/26/22. Got paid of 9/6/22 $1,520.31 (13% interest rate)